By the law of 20 November 2022, the legislator extends the tax authorities' examination and assessment periods, and consequently the mandatory retention period for tax payers' records and documents.

The new deadlines apply to corporate income tax, VAT, withholding - and real estate taxes and take effect from assessment year 2023.

In addition to granting more time to the tax authorities, the law also provides the possibility to impose an administrative fine to taxpayers unwilling to cooperate.

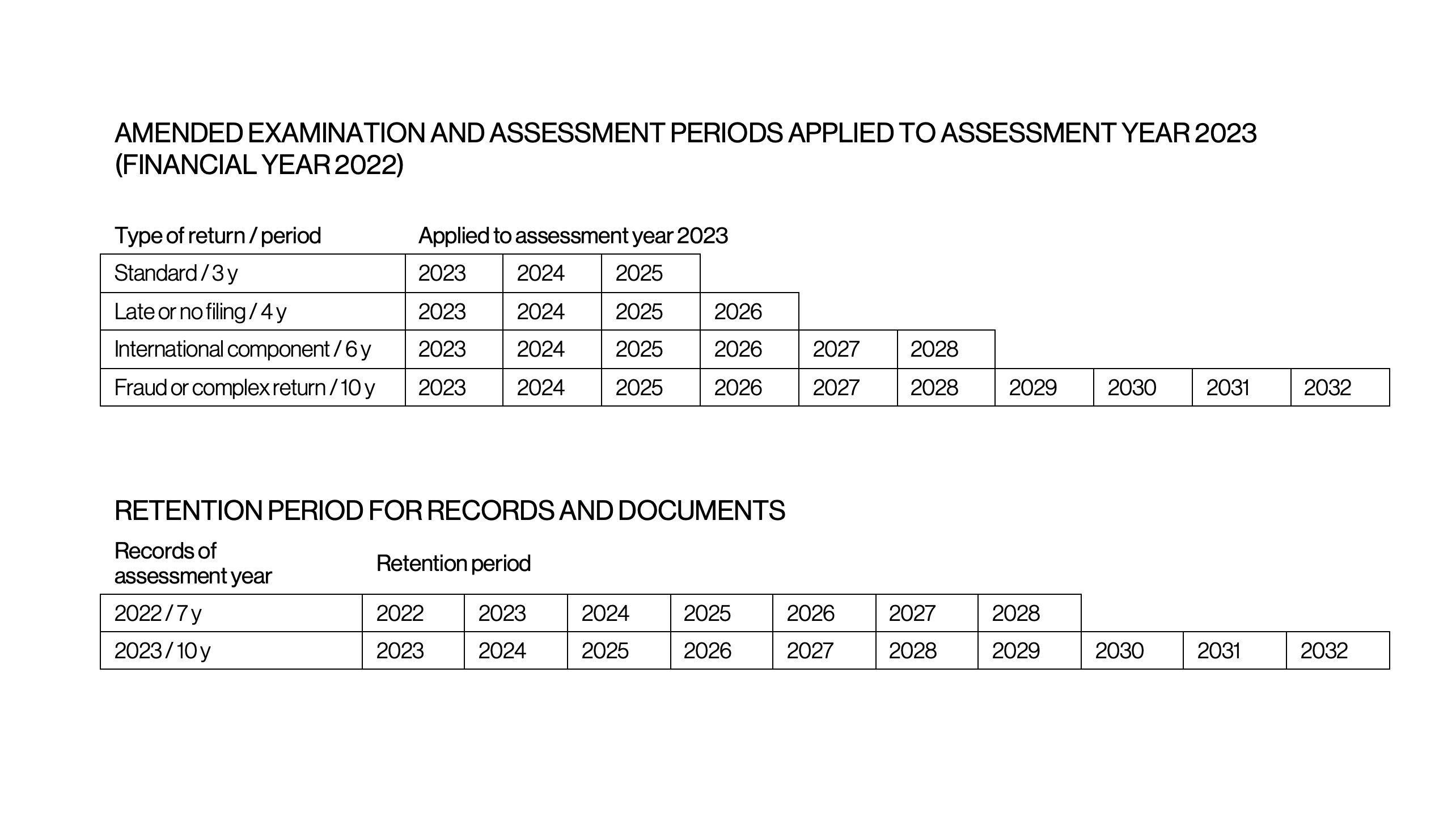

A. Longer examination and assessment periods

The standard period remains unchanged at 3 years.

In case of the late or absence of filing, the standard period extends to 4 years.

Specifically for returns with an international component (such as returns of companies subject to transfer pricing documentation obligations and returns with a reporting obligation of payments to tax havens) a 6-year examination and assessment period applies.

In case of suspicion of fraud, or in case of a complex return (such as legal constructions abroad), tax authorities can rely on the 10 year inspection and assessment period, previously reserved for exceptional circumstances only.

For certain elements, the extended periods do not apply. As such, the 6 or 10-year period cannot be applied for rectifications relating to certain non-deductible expenses (e.g. non-deductible car or restaurant expenses, etc.)

B. Longer retention period for records and documents

As a consequence, the retention period for accounting documents extends from 7 to 10 years, as from financial year 2022.

Please be aware that the following retention obligations remain unaffected:

- - Documents related to

- • real estate with VAT deduction must be kept for 15 or 25 years respectively;

- • current accounts (loans, donations, etc.) which are carried forward year-to-year must be kept for 7 and 10 years respectively, after the last year in which they appear on the balance sheet;

- • outstanding clients and suppliers (invoices, contracts, etc.) must be kept for 7 and 10 years respectively, after the last year in which the payables or receivables were settled.

- - Investment invoices that are written off must be kept for 7 and 10 years respectively, after the last year in which they were written off;

- - In case carried forward losses are deducted for tax purposes, the accounting records of the year in which the losses occurred should always be kept.

C. Longer objection period

The period to object issued tax bills is extended from 6 months to 1 year.

If you have any further questions, do not hesitate to contact us.

DISCLAIMER Our newsletters are purely informative and may under no circumstance be considered as constituting legal, tax or any kind of advice. Please contact us in the context of any interpretation or application of the information in this newsletter, in particular since legal and tax regulation are subject to regular amendments.